The 5-Second Trick For Will Filing Chapter 7 Bankruptcy Ruin My Life

The legislation is considerably diverse regarding life insurance. Life insurance proceeds are probable residence of the bankruptcy estate if you're entitled to them as the results of a Dying that transpired:

Don’t enroll with the initial credit card enterprise that sends you a fresh credit rating supply. Store all-around to start with. Figure out when there is an annual payment for owning the card.

Recall, your payment record is a large element On the subject of your credit history rating. At last, maintain the entire debt quantity on a card effectively beneath the credit score limit. Possessing plenty of unused credit in comparison with your complete financial debt sum improves your credit history score.

Their creditworthiness will help help your chances of securing favorable terms, as well as your on-time payments can lead to your favourable credit history record.

You can’t obtain a bankruptcy removed from your credit rating report early; neither can they. The credit rating reporting method is dependent upon regularity.

Irrespective of what sort of personal debt aid you select, be proactive about improving upon your credit score now and Down the road to assist lessen the destructive implications of specified aid choices.

Get yourself a cosigner. If you need a mortgage to order a vehicle or finance Yet another huge buy, you might contemplate asking a liked just one with fantastic credit rating Read Full Article to cosign the mortgage software.

Use Typical Feeling — You shouldn't file for bankruptcy should you’re going to get a read this post here big sum of money, for instance an inheritance.

A lot of people can exempt all their home in Chapter Source seven bankruptcy—but not generally. The Chapter 7 trustee can offer or liquidate nonexempt assets to pay for creditors. Usually, you will not be capable to exempt unnecessary luxury merchandise, such as a flashy car or truck or boat.

Bankruptcy is really a legal process that eradicates all or element of one's debt, although not with out serious consequences. Knowing the bankruptcy method, including the distinctive solutions as well as their ramifications, can help you ascertain irrespective of whether the advantages are worth the negatives.

For those who’re guiding on any credit card debt payments, your credit score rating could in all probability be improved. So, rather than stressing about quite possibly building your currently negative credit score worse, consider how a bankruptcy discharge could allow you to Construct credit.

Nonetheless, filing bankruptcy generally aids the filer’s click here for more info credit history score In the long term. As soon as your bankruptcy discharge is granted, you have got the opportunity to improve your credit history score instantly.

Here's what you need to know regarding how bankruptcy functions and what it requires to rebuild your credit rating afterward, together with some possibilities to think about initial.

… Or you might fit in an element-time career. … Or you might have expertise that may be useful from the gig financial system, or by freelancing. Investigate: click Opportunity for increasing your profits abounds.

Jenna Jameson Then & Now!

Jenna Jameson Then & Now! Danielle Fishel Then & Now!

Danielle Fishel Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Suri Cruise Then & Now!

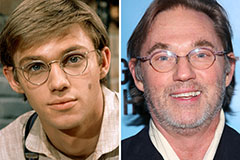

Suri Cruise Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now!